California Solar in 2026: Purchase vs Loan vs Lease vs PPA (and why prepaid leases are winning)

Get Your 3-Option Solar Plan for 2026

We’ll compare Purchase, PPA, and the 2026 favorite—Prepaid Lease using your actual usage + roof details. If you’re in SMUD territory, we’ll also check battery cash incentives where eligible.

- Honest: side-by-side options (no “free solar” nonsense)

- Fast: simple form, quick follow-up

- Accurate: based on your address + utility rate

Fill this out and we’ll send your next steps (and ask for a bill only if it’s needed).

Send me my 3-option plan

The more complete your info, the more accurate your estimate.

If you’ve been hearing “SGIP is dried up” and “the federal tax credit is gone,” you’re not crazy—2026 is a different solar market.

The federal Residential Clean Energy Credit (25D) is not available for property placed in service after December 31, 2025.

SGIP funding is not a simple on/off switch—it’s step-based by budget category and territory and can be open, waitlisted, or fully subscribed depending on where you live.

So what’s the move now?

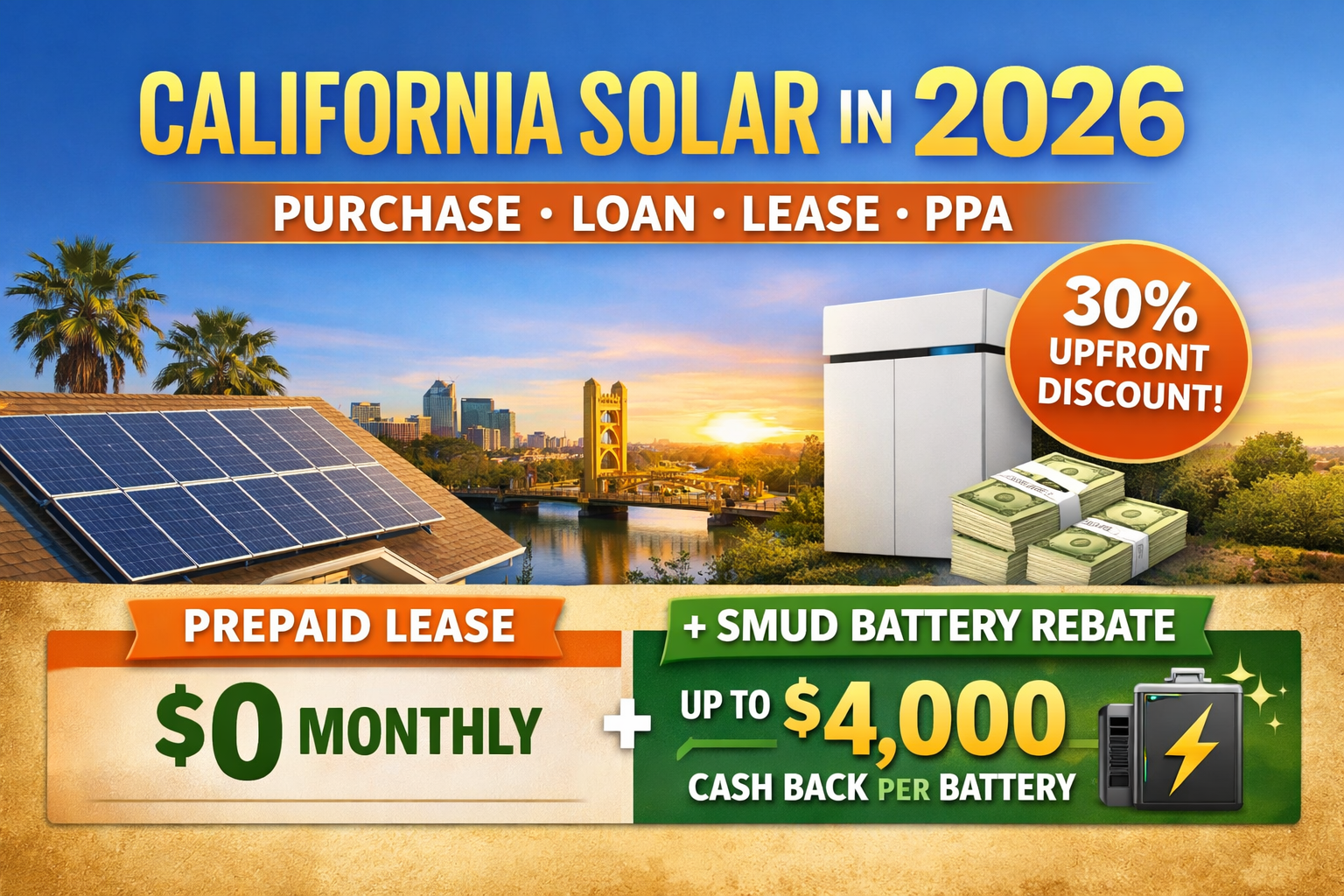

For a lot of California homeowners in 2026, the “sweet spot” is a prepaid lease (paid with cash or a loan) because it can be priced with a big upfront discount—often marketed around “30%”—to offset the missing tax credit without you needing a tax liability.

And in some areas (like SMUD territory), there may still be real utility cash incentives for batteries, which can stack with a prepaid lease strategy.

The 2026 decision in one sentence

If you want maximum long-term upside: ownership (cash/loan) can still be king—but sticker shock is real without 25D.

If you want “ownership-like savings” with simpler math and lower net cost: prepaid lease is often the cleanest 2026 play.

The 4 main options in 2026 (plain-English breakdown)

1) Cash purchase (ownership)

Best for: homeowners who want the highest long-term ROI and don’t mind writing the biggest check.

Watch-outs: you no longer have 25D to soften the upfront hit.

2) Loan purchase (ownership)

Best for: homeowners who want ownership but prefer to keep cash in the bank.

Watch-outs: interest rate + dealer fees can quietly decide whether this is a slam dunk or “meh.”

3) Traditional lease (fixed payment)

Best for: homeowners who want predictable payments and low/no upfront cost.

Watch-outs: read the contract like a detective—transfer terms matter if you sell.

4) PPA (pay per kWh)

Best for: homeowners who want low upfront cost and like the idea of paying for production.

Watch-outs: escalators and true cost over 20–25 years. A cheap Year 1 can get spicy later.

Bonus (the 2026 standout): Prepaid lease (paid by cash or loan)

Best for: homeowners who want a simple “net cost” story, strong savings, and less exposure to rate/finance weirdness.

Why it’s hot in 2026: the pricing is often structured to include an upfront discount (commonly pitched around “30%”) that helps replace what 25D used to do for homeowners—but it’s not a tax credit you claim.

Comparison table

| Option | Upfront cost | Monthly payment | Who owns it? | Who gets incentives? | Best for | Biggest “gotcha” |

|---|---|---|---|---|---|---|

| Cash Purchase | High | Low/none | Homeowner | Homeowner (but 25D is gone after 12/31/2025) | Long-term ROI | Big cash outlay |

| Loan Purchase | Low–Medium | Medium | Homeowner | Homeowner (but 25D is gone after 12/31/2025) | Ownership without writing a giant check | Rate + fees can wreck savings |

| Traditional Lease | Low–None | Medium | Solar company | Usually solar company | Predictable payment, low upfront | Transfer / buyout terms |

| PPA | Low–None | Varies (per kWh) | Solar company | Usually solar company | “Pay for what you use” mindset | Escalators + true 25-year cost |

| Prepaid Lease (cash or loan) | Medium–High (but discounted) | Low/none | Solar company | Usually solar company | Best “2026 math” for many | Must compare total cost apples-to-apples |

Sacramento/SMUD example: “30% upfront discount” + battery cash incentives (where available)

If you’re in SMUD territory, SMUD’s My Energy Optimizer Partner+ program offers a one-time enrollment incentive up to $10,000 per household for eligible new battery storage customers who enroll within 90 days of PTO, with the incentive calculated as:

Nameplate kWh × 80% × $500/kWh.

What that means in normal human numbers

Because the incentive is formula-based, the “per battery” dollar amount depends on battery size. For example:

A ~10 kWh battery works out to about $4,000 (10 × 0.8 × 500 = 4,000).

Larger batteries can be higher—until you hit the $10,000 per household limit.

So in the right SMUD-served parts of Sacramento County, a homeowner’s “2026 stack” can look like:

Prepaid lease (paid with cash or a loan) priced with a large upfront discount (often promoted around “30%”)

Plus potential SMUD battery incentive that may land around $4,000 per ~10 kWh battery (formula-based, household-capped)

Important: Incentives and eligibility depend on utility territory, rate enrollment, timing (like the 90-day PTO window), and program rules.

The 7 questions to ask before signing anything in 2026

What’s the total cost over 25 years (not just the “monthly”)?

Is there an escalator (lease/PPA)? How much?

If I sell my home, what’s required to transfer? Any fees? Buyer qualifications?

What are the buyout options (and when)?

What’s the production guarantee (if any), and what happens if it underperforms?

Who covers roof penetrations, monitoring, and warranty service?

Can you model savings using my last 12 months of usage (not a generic average)?

The honest 2026 recommendation (what we usually see)

If you’re planning to stay put long-term and want maximum upside: ownership (cash/loan) can still be great—just be realistic about the missing tax credit.

If you want the cleanest value story in 2026: prepaid lease is often the strongest balance of net cost + savings + simplicity.

If you’re in a utility area with battery incentives (like SMUD): batteries can be a bigger deal than ever, because export value isn’t what it used to be and incentives can meaningfully reduce battery cost.